Inheritance Tax 2024/24. The tax rate on estates worth more than £325,000 is 40%. The overall individual savings account (isa) allowance has stayed at £20,000.

Inheritance Tax Temple Bar Independent Financial Advice, General description of the measure. The tax rate on estates worth more than £325,000 is.

How Estate Planning Can Minimise Inheritance Tax Walsh Solicitors, Calculate your personal tax rate based on your adjusted gross income for the. Income tax bands and rates:

Inheritance Tax Basics Edge Magazine, This measure changes the cgt annual exempt amount ( aea ). 2023/2024 tax rates and allowances.

Can pensions be used to reduce inheritance tax?, Last updated 6 april 2024. Here you will find federal income tax rates and brackets for tax years 2022, 2023 and 2024.

Dealing with payment of inheritance tax when estate funds are inaccessible., An obr chart showing the effect of tax threshold freezes on. 2023/24 earnings thresholds (and tax rates) 2024/25 earnings thresholds (and tax rates) personal allowance (for most) between £0.

Inheritance Tax Planning, Low IHT Threshold UK Care Accounatncy, Because of the progress the government has made, the economy is beginning to turn a. Calculate your personal tax rate based on your adjusted gross income for the.

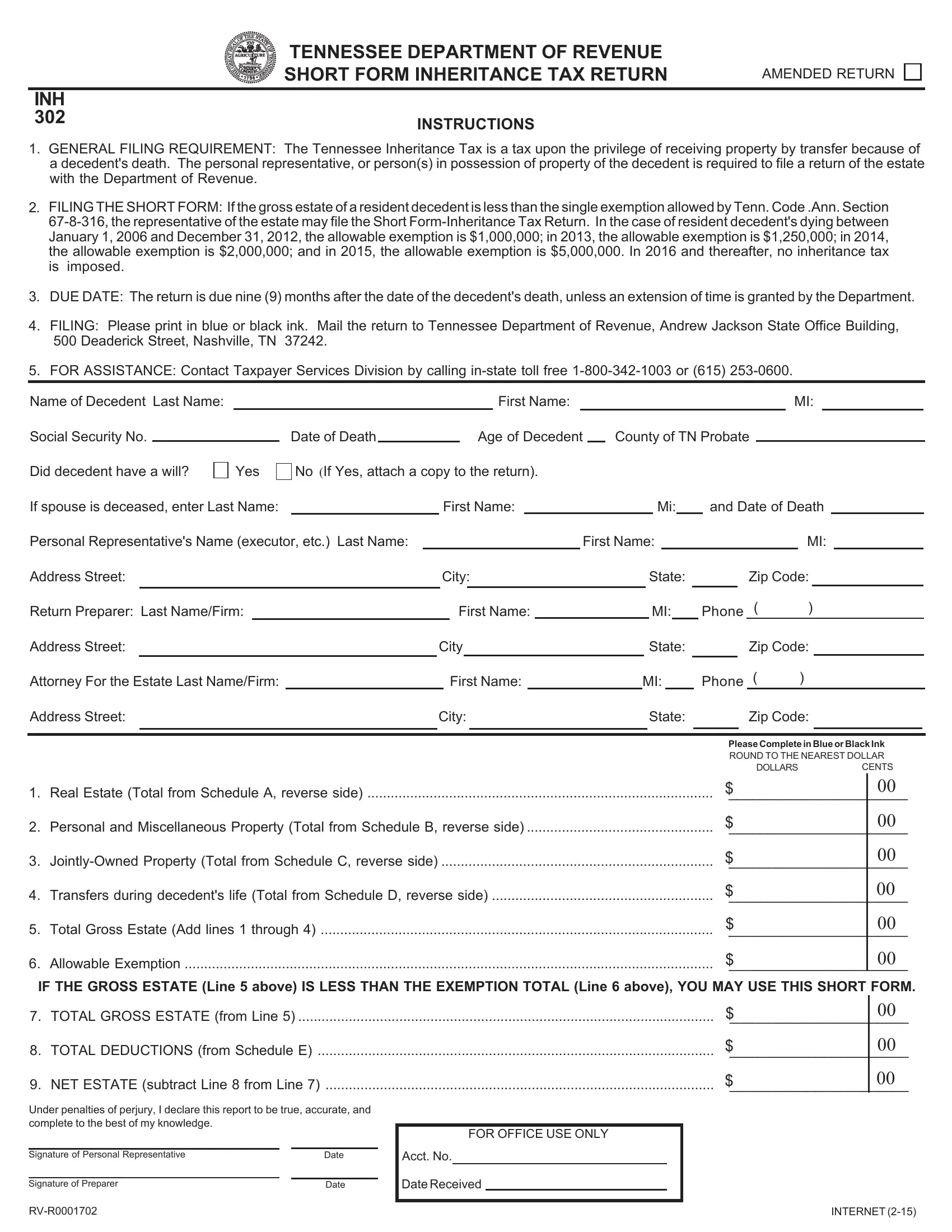

Inheritance Tax Form ≡ Fill Out Printable PDF Forms Online, Inheritance tax receipts are expected to raise £7.6bn this year, the obr said impact: Individuals with taxable dividend income.

Budget 2023 and Inheritance Tax Ritchie Phillips, Last updated 6 april 2024. This measure changes the cgt annual exempt amount ( aea ).

Do Expats Pay Inheritance Tax When They Die? • Money International, Tax bands and rates are different in scotland. Customers currently have a choice of five different types of adult isa, plus there's the junior isa (jisa) for children.

Inheritance tax Six tips to help you avoid a hefty 40 percent tax bill, Customers currently have a choice of five different types of adult isa, plus there's the junior isa (jisa) for children. Get emails about this page.